Article

Maximising impact in philanthropy: How blended finance scales impact

29 October 2024 | 6 minute read

In today's rapidly evolving philanthropy landscape, family offices, high-net-worth individuals, and impact-driven investors are exploring new ways to maximize their contributions.

As global challenges such as climate change and healthcare disparities intensify, traditional forms of giving are proving insufficient to bridge the gap between available resources and the scale of the solutions needed. Rising sea levels, extreme weather events and increasing temperatures are expected to affect over 3.3 billion people globally, placing immense strain on resources. Much of Asia, including Singapore, also face impending demographic shifts including a 'silver tsunami' which refers to an anticipated wave of aging citizens. These factors highlight the need for innovative financing solutions that can address systemic challenges across multiple sectors, including healthcare and social support systems.

One powerful financial tool that is emerging at the intersection of philanthropy and investment is blended finance. This innovative approach harnesses the power of both philanthropic, public and private sector capital, multiplying the impact of each dollar contributed. Beyond just fulfilling charitable goals, blended finance structures can also offer valuable financial incentives for family offices, particularly in jurisdictions like Singapore, where recent changes to tax exemption schemes make it a compelling option.

This article delves into how blended finance works, its relevance in the modern philanthropy space, and why it is an optimal strategy for scaling impact while maximizing financial returns.

What is blended finance?

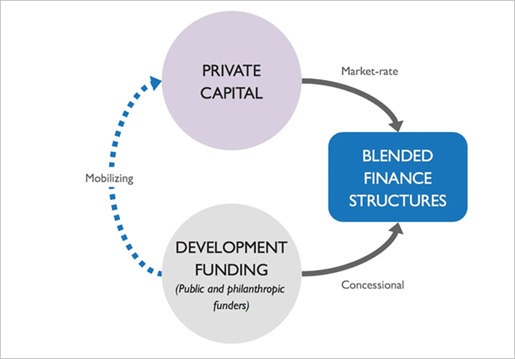

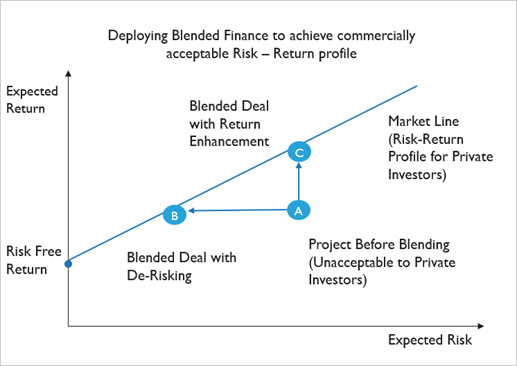

In essence, blended finance is a strategic financial structure that uses concessional and philanthropic funds to attract private sector investment in sustainable projects. By “blending” the different types of capital from both public and philanthropic sources, each with its unique risk tolerance and return expectations, blended finance enables projects that would otherwise be too risky or unprofitable for traditional investors to be scaled effectively, by attracting such private sector investments. In turn, it is anticipated for the projects to generate commercial returns, as well as positive social, developmental and environmental impacts on the target beneficiary community.

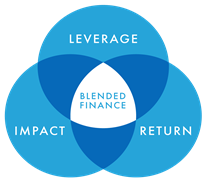

Key characteristics of a blended finance structure:

Image: Convergence

- Leveraging capital: Multiplying the impact of each philanthropic or concessional dollar – deploying concessional or philanthropic capital to create acceptable risk-return profiles to mobilise commercial capital.

Image: Convergence

- Ensuring impact: Projects funded through blended finance structures are designed to contribute to a social development goal, though not all parties to a blended finance transaction need to have such social development intent.

- Ensuring returns: Projects funded through blended finance structures are designed to generate financial returns for private sector investors (whether concessional or market rate returns).

Image: Convergence

How is blended finance relevant in today’s philanthropy landscape?

The reality is that more has to be done in the philanthropic and social development space. Pure philanthropy and aid dollars can only do so much and, in light of the pressing global issues (e.g., climate change) that are confronting us, blended finance structures become important and relevant as they complement philanthropic dollars and ensure that the impact of such philanthropic dollars is maximised.

The United Nations has estimated that over 4 trillion dollars is required to achieve the Sustainable Development Goals by 2030. Traditional donations and grants alone simply cannot bridge this gap. This is where blended finance structures come in to complement pure philanthropy and aid dollars: offering a solution by mobilising commercial capital, in turn enhancing the pool of resources available for good.

1. Amplifying impact by leveraging capital

By deploying philanthropic or concessional capital to create acceptable risk-return profiles for commercial investors in relation to impact or sustainable projects, blended finance structures serve as a viable avenue to attract commercial capital, thus scaling the impact of philanthropic and concessional capital. Blended finance structures are estimated to enable every dollar of concessional capital to unlock four dollars of private sector funding. A four-times multiplier is significant when we think about the millions and billions of dollars that could help close the funding gap for important social developmental goals.

For instance, in addition to an outright donation, a charitable foundation might also provide a concessional loan in a blended finance structure. Where the foundation bears non-market levels of risk and accept lower returns compared to other private investors, this in turn helps to reduce the overall risk to the private investors and hence makes the investment more appealing to them, which helps mobilise commercial capital. The range of possible instruments are endless, and they include first loss guarantees, junior equity, and technical assistance grants. This approach not only brings in extra monetary resources but also helps the project grow and last over time having a much bigger impact than just relying on traditional direct donations and grants. Through blended finance structures, donors can also be more thoughtful and intentional on the precise way in which they wish to give and support the sustainable goals.

2. Ensuring long-term sustainability

Blended finance offers an avenue to ensure that philanthropic dollars are not just one-off charitable donations, but instead serve as catalysts in precipitating lasting change. It is for this reason that projects funded through blended finance are intentionally structured to be financially viable in the long term, reducing the need for ongoing philanthropic funding, essentially creating a self-sufficient loop. This allows the initial philanthropic and concessional capital to catalyse, generating impact well into the future.

Effectively, contributions to blended finance projects should not be viewed as if made as a one-off donation to a charitable cause. Instead, it would indeed be apt to view them as investments in sustainable and scalable projects that can drive long-term impact on the target beneficiaries and developmental goals without solely relying on philanthropic dollars. This aligns with the increasing focus among donors on creating a lasting legacy and ensuring that their wealth continues to generate impact.

3. Addressing systemic issues at scale

Many systemic challenges faced by global communities such as climate change, and access to healthcare and basic resources, demand for modernised, long-term solutions that operate at scale. Blended finance tackles these systemic issues by pooling resources from all stakeholders, which can include commercial investors, private donors and governmental bodies.

It is through blended finance that innovation is encouraged and funded – the capital derived from blended finance enables the testing and scaling of innovative solutions that would traditionally be deemed as too risky or not commercially viable for private investors to fund alone. Such inventive solutions which are often a times, costly, are of particular importance in areas such as food security, energy, healthcare, and education, where innovative approaches could be the key in addressing.

Blended finance initiatives will play an indispensable role in funding solutions to global challenges that would be impossible to solve through traditional charitable funding alone. The goal of blended finance is to drive systemic change, creating impact that goes beyond – contributing to broader global goals.

Blended finance in practice

To further understand how blended finance structures are being effectively implemented across various sectors, reports such as Convergence’s 2024 State of Blended Finance and the UNEP FI blended finance case studies provide insightful examples. These reports highlight how concessional capital has successfully mobilized private investment in areas like renewable energy, healthcare, and sustainable infrastructure, demonstrating the scalability and impact of blended finance in addressing systemic global challenges.

Maximising philanthropic dollars

As the global philanthropy landscape continues to evolve, donors are increasingly seeking innovative pathways to maximise the impact of their philanthropic dollars. The way we see philanthropy is also changing; and blended finance offers a strategic framework to achieving long-lasting philanthropic impact by leveraging philanthropic and concessional capital to attract private sector investment, driving innovation, and ensuring sustainability of solutions on a self-sustaining loop.

From the perspective of encouraging greater participation in blended finance structures by family funds managed by single-family offices (of which there are at least 1,650 of them in Singapore as at August 2024), the Monetary Authority of Singapore has since last year refined its section 13O and section 13U fund tax exemption schemes (as relates to single-family offices and family funds) to provide for recognition (in varying forms and degrees) when it comes to fulfilling the respective schemes' tiered spending and minimum capital deployment requirements should such incentivised funds contribute to or invest in such structures. [Read our previous update on the new Philanthropy Tax Incentive Scheme for Singapore family offices and changes to the Fund Tax Exemption regimes with effect from 5 July 2023 here] The hope is that by providing such incentives, family funds will be motivated to participate in such blended finance structures which will in turn create positive spillovers.

This article is based on insights shared during an event on blended financing hosted by Withersworldwide in collaboration with Convergence earlier this year. We extend our thanks to Convergence for their partnership in bringing together valuable perspectives on this topic.