Article

Hong Kong Court of Appeal tightens stamp duty relief exemption for intra-group transfers

11 July 2024 | Applicable law: Hong Kong | 4 minute read

On 5 July 2024, the Court of Appeal overturned the District Court's decision in the case of John Wiley & Sons UK2 LLP and Another v The Collector of Stamp Revenue.1

This case examined the application of the intra-group stamp duty relief pursuant to section 45 of the Stamp Duty Ordinance2 (the "Relief") and ruled that the "associated body corporates" requirement for qualification to the Relief should be interpreted narrowly.

1. Background and appeal history

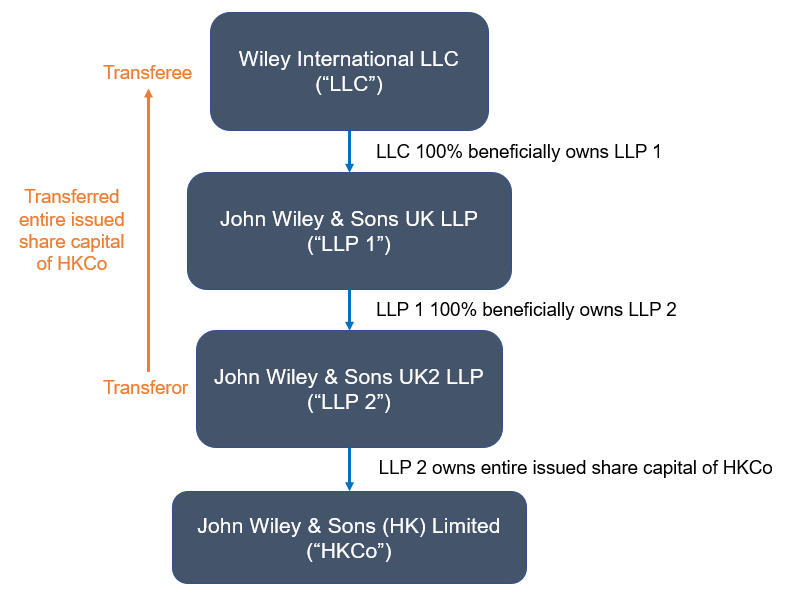

As part of an internal group restructuring, shares in a Hong Kong company which is 100% owned by John Wiley & Sons UK2 LLP ("LLP 2"), a UK Limited Liability Partnership, were transferred to Wiley International LLC ("LLC"), a Delaware Limited Liability Company. LLP 2 is wholly beneficially owned by John Wiley & Sons UK LLP ("LLP 1"), which is, in turn, wholly beneficially owned by LLC. LLP 2 and LLC (collectively, the "Duty Payors") sought the Relief in respect of the Hong Kong share transfer.

As a short recap, the Relief is available if the transferor and transferee are "associated body corporates". Two body corporates satisfy the association requirement if (i) one body corporate is the beneficial owner of at least 90% of the "issued share capital" of the other, or (ii) both body corporates have a common corporate shareholder, who is the beneficial owner of not less than 90% of the "issued share capital" of each.

The Collector of Stamp Revenue rejected the Duty Payors' application for the Relief on the basis that LLC's indirect beneficial ownership of LLP 2 does not satisfy the association requirement, as participation interest in a Limited Liability Partnership cannot be interpreted as "issued share capital" 3.

1.1 District Court's decision

On the Duty Payors' appeal to the District Court, the District Court found in favour of the Duty Payors and in doing so, adopted a liberal interpretation of "issued share capital". The District Court considered that "issued share capital" should not be restricted to the capital of a share-issuing entity. A body corporate has a "share capital" if its capital is divisible into quantifiable portions and the percentage of its ownership can be determined. Relief should be available to 'all associated groups regardless of whether their members were incorporated as companies with limited liability or incorporated as other forms of bodies corporates'.4 While LLP2 is not a share-issuing entity, it has an issued share capital, which was subscribed in quantifiable portions by its initial members. Accordingly, the Duty Payors have satisfied the association requirement.

1.2 Court of Appeal's decision

On the Collector's appeal, the Court of Appeal overturned the District Court's decision and opted for a narrower interpretation of "issued share capital" and "associated body corporates". The Court of Appeal determined that the term "issued share capital" in the context of the Relief should be understood as it is in company law. This means "issued share capital" should refer to the total amount of money that shareholders have paid, or agreed to pay, for the shares issued by the company5. Given LLP1 and LLP2 do not issue shares, the Duty Payors cannot satisfy the association requirement.

Despite the use of the words "body corporate" under section 45 (2) of the Stamp Duty Ordinance, this term merely includes foreign companies in addition to a company incorporated under the Companies Ordinance in Hong Kong, the legislative intent for the Relief remains to be that it is available for associated 'companies' only rather than any type of corporate entities.6

2. Implications for corporate and trust restructuring

The narrow application of the Relief, as decided by the Court of Appeal, would mean the Relief is unlikely applicable to corporate restructuring involving direct or intermediate members of a group that are non-share-issuing entities.

Frequently asked questions concerning trust structuring are: if shares in Hong Kong companies or Hong Kong real properties are 1) transferred from a trust (which may have received such assets pursuant to the will of a deceased) to a private investment holding company ("PIC") held under the trust, or 2) transferred from one PIC under a trust to another PIC under the same trust, whether the Relief would be available.

Applying the narrow interpretation of the "associated body corporates" by the Court of Appeal, it is unlikely that the Relief should apply since a) a trust (which is just a legal relationship) is not a company, thus the trust and its PICs are not "associated body corporates', while b) the trustee (which is usually a company) is not the beneficial owner of the PIC, and thus the trustee and the PICs would also fail to meet the association requirement.

3. Takeaway

It remains to be seen whether the Duty Payors will further appeal to the Court of Final Appeal. However, in the meantime, it is of utmost importance that corporate structures are crafted carefully in the initial set-up to provide maximum stamp duty savings potential in any potential restructuring exercises in the future. In the context of preparing a will, the PIC (rather than the trust) should be named as a beneficiary if any Hong Kong company shares or real estate will be transferred into a trust structure administered by an institutional trustee on death.

Should you have any questions, please feel free to reach out to Daniel Tang or Deirdre Fu for a consultation.

2 Section 45 of the Stamp Duty Ordinance [click here]

3 Cf paragraph 17 of the CA Judgement

4 See John Wiley & Sons UK2 LLP and Another v The Collector of Stamp Revenue [2022] HKDC 716, paragraph 46-48 [judgment]

5 Cf paragraph 69 of the CA Judgement

6 Cf paragraph 68 of the CA Judgement